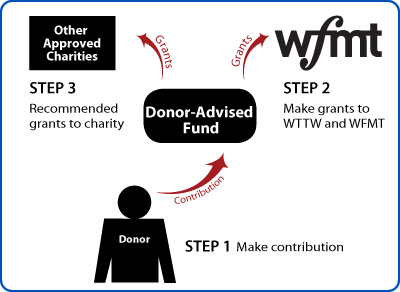

Donor-Advised Fund

How It Works

- You create a donor-advised fund (DAF) with the charitable sponsor of your choice

- You advise your charitable sponsor where you want to make charitable contributions

- You may make recommendations for additional charitable contributions to approved charities

Benefits

- You create a DAF to support WTTW and WFMT and other charities

- You receive an income-tax deduction for your original contribution to the DAF

- Your DAF will receive professional asset management

- You have the flexibility of making grants to charities on your time

Next Steps

© Pentera, Inc. Planned giving content. All rights reserved.